Former L.A. City Council Member Tom LaBonge and ‘Scandal’ star Joe Morton hosted the 2016 Made In Hollywood Honors award ceremony.

The talk of the event was the $330 million tax credit program that makes shooting in California cheaper for studios.

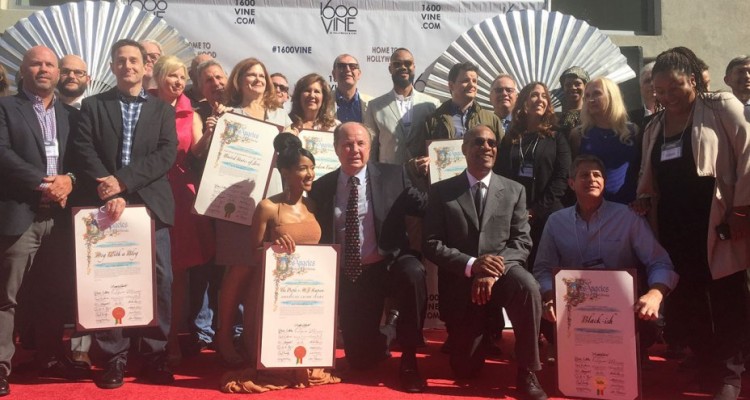

City officials, guild members, TV stars and union reps gathered Wednesday morning at 1600 Vine across from the Pantages Theater to celebrate the 2016 Emmy-nominated television shows that were produced in California and the Los Angeles area.

While the producers of hits like The Simpsons, HBO’s All the Way and The People v. O.J. Simpson: American Crime Story received commemorative, calligraphy-laden certificates to adorn their writers’ rooms, the real star of the show was the 2-year-old, $330 million tax credit program that makes shooting in California significantly cheaper for studios and independent producers.

“We’re contributing to the economy of California,” Ed Duffy, vice president of Teamsters Local 399, told The Hollywood Reporter, “but we’re also letting people know that this is the place where movies and TV shows get made.”

Six major television shows have returned to the L.A. area as a result of the incentive program, including Veep from Maryland and American Horror Story from Louisiana, according to a statement from the California Film Commission.

The CFC also credits the program for $1.7 billion in direct in-state spending for full fiscal 2016 and $600 million in below-the-line wages for workers like grips, gaffers and truck drivers.

Similar tax relief programs have taken off with state legislatures across the country over the past fifteen years. As a recent survey by THR previously showed, thirty-five states now offer some sort of tax incentive structure for film and television companies to bring their productions within state lines, infusing local economies with cash and job opportunities.

That’s in addition to international destinations like New Zealand and Vancouver, Canada, nicknamed “Hollywood North” for its industry-attracting incentives.

But Hollywood union reps are quick to distinguish California’s below-the-line tax credit program from others that are based on a production’s entire budget, which can often factor in enormous fees for directors, writers and top-billed actors.

“If you’re shooting in Atlanta or Louisiana,” Duffy said, “the credits can go to Brad Pitt’s salary.”

“Made in Hollywood Honors” was established in 2011 and was sponsored by District 13 council member Mitch O’Farrell, SAG-AFTRA, the California Film Commission, Teamsters Local 399 and the Producers Guild of America, among other organizations.

“We really believe that this is a middle-class program,” Steve Dayan, treasurer of Local 399, told THR. “We’re now at full employment for the first time in a decade.”

But not everyone agrees that these programs are money well spent. Two studies published this summer by USC economist Michael Thom found that tax incentives had no long-term effect on wages and only a small effect on employment numbers. They also found that the programs didn’t cause the industry to expand beyond its traditional capitals in California and New York, where it’s been based for decades.

The studies were of little concern at 1600 Vine Wednesday morning, however, where guests posed for photos with their certificates and expressed no small amount of hometown pride.

“We feel good old-fashioned proud,” Matthew Nelson, Emmy-nominated producer of Girl Meets World, told THR. “It’s good to do it here. And I really like my commute.”

Leave a Reply